When someone is injured in a car accident in Ontario, getting compensation for pain and suffering (known in law as non-pecuniary general damages) isn’t as straightforward as adding up bills or receipts. Ontario’s auto insurance law imposes special rules – a “threshold” injury requirement and a large statutory deductible – that can bar or significantly reduce awards for pain and suffering. These concepts are crucial for both lawyers and accident victims to understand, as they determine whether and how much a person can recover for their intangible losses. In this post, we’ll explain in clear terms what the threshold and deductible are, why they exist, and how they affect claims for injury compensation in Ontario. We’ll also distinguish these non-pecuniary damages from “pecuniary” losses (like lost income or costs) which are treated differently. Our aim is to make these legal principles accessible to both legal professionals and those without a legal background.

Pecuniary vs. Non-Pecuniary Damages: What’s the Difference?

Pecuniary damages refer to financial losses that can be quantified in money – things like medical expenses, rehabilitation costs, lost wages, repair bills, or the cost of renting a replacement vehicle after an accident. These are sometimes called “special damages” and are straightforward: if you paid out \$1,000 for a car rental because your car was damaged, or you lost \$5,000 in income while off work injured, those amounts are pecuniary losses. As long as you can prove these expenses or losses were caused by the accident and that they were reasonable, you are entitled to claim them in full.

Non-pecuniary damages, on the other hand, are the intangible losses – most commonly compensation for pain and suffering, emotional distress, and loss of enjoyment of life. These are often called “general damages”. Unlike a bill or paycheck stub, pain and suffering can’t be measured with a calculator. They encompass things like physical pain, mental anguish, inconvenience, and the ways in which an injury diminishes your quality of life or mental well-being[1]. For example, chronic back pain that makes it hard to play with your kids, or anxiety that stops you from driving again, are non-pecuniary losses. Canadian law recognizes these as real harms, but putting a dollar figure on them is inherently challenging[1].

Why does this distinction matter? Because in Ontario auto accident claims, special legal limitations apply only to non-pecuniary damages. In other words, while you can recover every penny of your proven pecuniary losses, your ability to recover anything for pain and suffering is limited by the threshold test and the statutory deductible. We’ll explore each of those in turn.

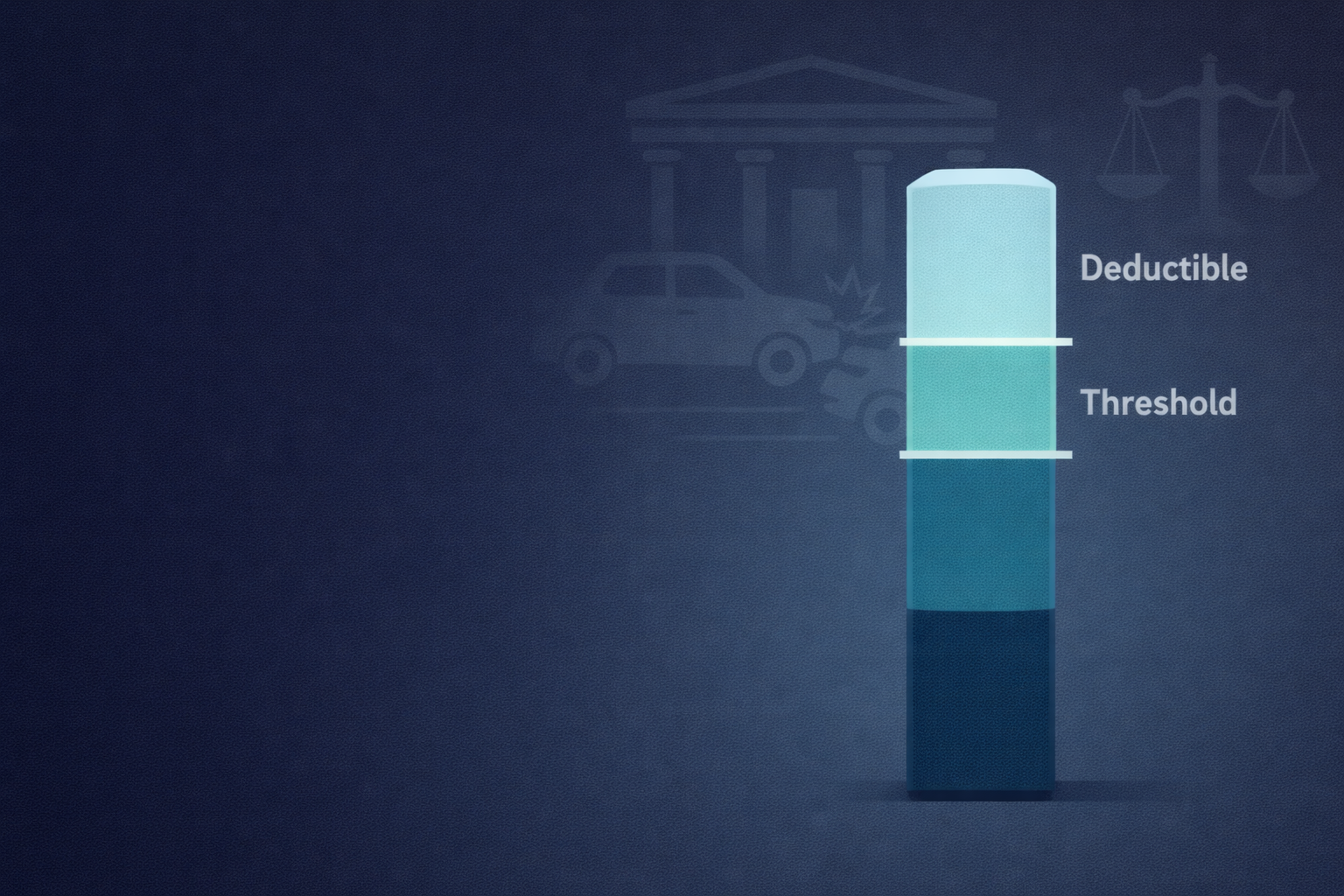

The “Threshold” for Non-Pecuniary Damages in Ontario Auto Accidents

Ontario’s Insurance Act sets a high bar that an injury must meet before an at-fault driver can be made to pay non-pecuniary (pain and suffering) damages in a car accident case. This is often called the verbal threshold (because it’s defined by words in the statute) or simply “the threshold.” Section 267.5(5) of the Insurance Act provides that no damages for pain and suffering can be awarded from a motor vehicle accident unless the injured person has died or has sustained one of the following due to the accident[2]:

- Permanent serious disfigurement, or

- Permanent serious impairment of an important physical, mental, or psychological function[3].

In plain language, this means your injuries must be serious and lasting. If they are temporary or minor, the law says you are not entitled to any money for pain and suffering[4]. This rule was instituted to prevent compensation for very minor injuries and to help keep insurance costs in check[5]. It effectively filters out claims for pain and suffering unless the injury crosses a certain severity threshold.

It’s important to note that psychological injuries count too. The law isn’t limited to visible physical injuries. A mental or emotional injury can qualify as a “bodily injury” under the threshold, as long as it seriously impairs your life in a permanent way[6]. The Supreme Court of Canada has affirmed that mental injuries are not to be treated as less real than physical ones. For example, conditions like post-traumatic stress disorder (PTSD), chronic depression, or serious anxiety after an accident can potentially meet the threshold, provided they are permanent and serious in their effects. What matters is the impact of the injury on a person’s functioning, not just the form of the injury.

Defining “Permanent” and “Serious” Impairment

The terms “permanent serious impairment of an important function” are further defined in the regulations and case law. In practical terms:

- Permanent means the injury or impairment is of indefinite duration, with no reasonable prospect of recovery. It doesn’t have to be absolute forever – but it isn’t just a short-term problem. There should be some element of lasting or long-term effect. Typically, medical evidence (e.g. reports from physicians or specialists) is required to establish that an impairment is ongoing and not likely to fully resolve[7][8].

- Serious means the impairment substantially affects your life or causes substantial interference with your daily activities. Ontario courts use a common-sense inquiry: does the injury seriously affect the person’s ability to function or enjoy life? The Court of Appeal outlined a useful three-part test for determining this, often cited from Meyer v. Bright. The court asks: (1) Has the injured person sustained a permanent impairment of a physical, mental, or psychological function? (2) If yes, is that function important to the person? (3) If yes, is the impairment of that important function serious?[9] Each element must be met to satisfy the threshold.

An “important” function usually means an ability that is necessary for the person’s regular activities or roles – for example, the ability to work, to care for oneself or family, to move about, or to participate in activities that are significant to their life. An impairment is considered “serious” if it impacts those important areas in a substantial way. A person need not be completely incapacitated to be seriously impaired. For instance, someone might have returned to work and daily chores, yet still experience chronic, relentless pain that significantly diminishes their quality of life. Courts have found that if ongoing symptoms (like constant pain, severe headaches, sleep difficulties, etc.) seriously affect a person’s enjoyment of life and usual activities, that can qualify as a serious impairment even if the person manages to carry on some routines[10]. The key is that the injury goes beyond tolerable pain or inconvenience – it strikes at the person’s ability to live a normal life in a meaningful way[11].

By contrast, injuries that are transient or trifling will not meet the threshold. For example, if someone suffers whiplash or headaches for a few weeks but then fully recovers, or experiences short-term emotional upset that doesn’t last, those would fail the test. In one Supreme Court case, Saadati v. Moorhead (2017), the plaintiff had no physical injuries but suffered psychological harm from an accident; the Court confirmed that psychological harm can be compensable on equal footing with physical harm – but still, in an Ontario car accident case, that psychological injury must be serious and permanent to get around the threshold rule[6].

In practice, the threshold is a strict gatekeeper[4]. Many plaintiffs with modest injuries find that, no matter how real their pain is, if it eventually heals or doesn’t substantially interfere with their life long-term, they cannot recover any general damages for pain and suffering. The threshold issue is usually decided by a judge (often on a motion at trial, after the evidence is in). If the judge finds the threshold not met, the pain and suffering claim is dismissed outright – meaning the jury (or judge, in a non-jury trial) could have found the defendant liable and even assigned an amount for pain and suffering, but the plaintiff still gets zero for general damages because of this legal bar[12][5].

The Statutory Deductible: A Further Limit on Pain and Suffering Awards

Surviving the threshold test is only part of the battle. Ontario law also imposes a statutory deductible on non-pecuniary damage awards. Think of this as a built-in subtraction from whatever amount a plaintiff is awarded for pain and suffering. Even after proving a serious, permanent injury, an injured person’s general damages award may be slashed by a large deductible under the Insurance Act[13].

The deductible is a fixed dollar amount (indexed to inflation each year) that is subtracted from the pain and suffering award. If the award is smaller than the deductible, the result is that the plaintiff receives nothing for pain and suffering. If the award is larger than the deductible, the plaintiff only gets the difference. For example, as of 2024, the deductible is $46,053.20 for general damages awards[14]. So:

- If a jury (or judge) assesses a plaintiff’s pain and suffering at, say, $40,000, this is below the deductible – the injured person would get $0, because the entire award is “wiped out” by the \$46k deductible[15].

- If the pain and suffering is valued at $70,000, which is above the deductible, the plaintiff would recover the amount above the deductible. $70,000 minus $46,053.20 leaves about $23,946.80 payable to the plaintiff[14].

- Only if the pain and suffering award reaches a certain high threshold does the deductible disappear entirely. In 2024, if general damages are assessed above roughly $153,000, then no deductible is applied[16]. (This cutoff is often called the “monetary threshold” or “vanishing deductible” point. It was about \$153,500 in 2024 and indexed to about \$155,000 in 2025[17].)

These figures change every year for inflation. By way of illustration, in 2023 the deductible was about \$44,367 and the vanishing point about \$147,890; in 2024 those rose to \$46,053 and \$153,509, and in 2025 the deductible is roughly \$46,790 with a \$155,964 vanishing point[18][17]. The trend is that the deductible keeps creeping upward annually. This means it’s becoming increasingly challenging for accident victims with moderate injuries to receive meaningful pain and suffering compensation[19][5]. An award that might have been paid out a few years ago could now be entirely offset by the growing deductible.

It’s worth noting that the deductible also applies (at a lower amount) to family members’ claims for loss of care, guidance, and companionship under the Family Law Act[13]. For instance, a spouse or child of an injured person can sue for the emotional loss of having their loved one injured – but those awards face a separate deductible (approximately half the main deductible). In 2024, the family-member deductible was about \$23,026 (waived if the family member’s award exceeds about \$76,754)[20][16]. Additionally, there are a couple of narrow exceptions where no deductible applies: notably, if the injured person dies (wrongful death claims under the Family Law Act) the deductible is waived[21], and as mentioned, if the non-pecuniary award is above the statutory monetary threshold (~\$155k in recent years) then by law the deductible is not applied[16].

The practical effect of the statutory deductible is that many awards for pain and suffering get drastically reduced. Juries in trial cases are not told about the existence of this deductible[12]. They might award what they think is fair for a plaintiff’s pain – say \$50,000 – not realizing that the plaintiff will end up with only a few thousand (since \$50k minus the deductible leaves under \$4k in that scenario)[22]. The deductible thus often frustrates plaintiffs’ expectations and, some argue, the intention of the jury. From the claimant’s perspective, it can feel like an unfair secret penalty. From a policy perspective, however, the deductible (together with the threshold) was designed to discourage lawsuits for minor injuries and to save insurance companies money in payouts[5][23]. In effect, the law inserts the risk that an injured person might go through litigation and end up with nothing for pain and suffering – a risk that undoubtedly dissuades some from pursuing smaller claims. Insurance industry proponents argue this helps keep auto insurance premiums lower by weeding out minor claims; plaintiff advocates argue it’s a heavy-handed tool that denies compensation to many genuinely injured people whose pain, while real, is deemed not enough by these standards[5][23].

It should also be mentioned that, separate from the threshold and deductible, Canadian law imposes an upper cap on non-pecuniary damages for the most severe injuries. The Supreme Court of Canada set a cap of \$100,000 in 1978 for catastrophic injuries like quadriplegia or severe brain damage, which with inflation is around \$460,000 today[24]. No matter how horrific the injury, pain and suffering awards generally cannot exceed that cap (though the cap increases with inflation over time). Most car accident claims, however, don’t approach this cap – the threshold and deductible are usually the controlling factors in ordinary cases of soft-tissue injury, fractures, psychological trauma, etc. The cap is relevant in the most extreme cases, whereas the threshold and deductible impact a broad range of low-to-moderate injury cases.

What Does This Mean for Accident Victims? (Minor vs. Serious Injuries)

These rules mean that if you have only relatively minor or transient injuries, you will likely recover nothing for pain and suffering in a car accident lawsuit. For example, if you suffered some aches, bruises, or emotional upset that fully healed in a short time, your injury won’t meet the “permanent serious impairment” threshold – your claim for non-pecuniary damages is barred by law[4]. Even if you did sue and proved the other driver was at fault, a judge would likely dismiss your pain and suffering claim due to the threshold rule. (You could still recover your pecuniary losses, like any medical treatment costs or vehicle damage, as explained below.) Ontario’s regime is essentially saying that “pain and suffering” compensation is reserved for those with serious, long-lasting injuries – people who were truly seriously hurt in the eyes of the law.

If you do have a serious and permanent injury, you clear the threshold and can be awarded general damages – but you still face the deductible if your award is on the lower side. Many soft-tissue injuries, chronic pain cases, or psychological injuries might meet the threshold (especially with supportive medical evidence and testimony showing how badly the injury affects your life). But the value of such pain and suffering might be assessed at, say, \$30,000 or \$50,000 by a court, given the ranges seen in past cases. As we’ve seen, a \$30k award would be entirely erased by the deductible, and a \$50k award would be mostly erased. In practical terms, only more significant pain and suffering awards yield substantial net compensation. A plaintiff whose pain and suffering is valued around \$100,000, for instance, would net roughly \$54,000 after the current deductible – better than nothing, but still a big chunk taken off. Not until an award exceeds the ~$150k range does the plaintiff get to keep every dollar awarded[16].

It’s also important to manage expectations: many people imagine they will be compensated for any pain from an accident, but under this system a moderate injury often results in zero dollars for pain and suffering. Ontario’s threshold and deductible have been criticized as harsh – even trial judges have called the deductible a “significant and unfair barrier” for injured people[23]. But unfair or not, these are the rules in place. Lawyers pursuing car accident claims must advise their clients upfront that unless the injury is clearly serious and permanent, a tort claim for pain and suffering may not be viable or worthwhile.

The Silver Lining: Pecuniary Losses Are Still Recoverable

There is no threshold or deductible for pecuniary damages. This means that any out-of-pocket expenses or financial losses caused by the accident can be claimed in full (subject only to proving the amount and that it was reasonably necessary). The law only targets non-pecuniary pain-and-suffering awards with the threshold and deductible[25]. So, if you incurred special damages – for example, you had to pay for prescription medications, therapy sessions, repair costs, a rental car, or you lost income from missing work – those losses are not subject to the threshold or the deductible. Even if your injury was minor, you can still recover money for these concrete losses. In our initial example, the plaintiff who couldn’t get \$10,000 for pain and suffering could still recover the approximately \$1,826 in documented expenses for rental cars and transportation, because those are real pecuniary losses. The only requirement is that the plaintiff prove causation and quantum – i.e., show that these expenses flowed from the accident and the amounts are reasonable[26]. Ontario courts will award such special damages as long as you demonstrate they were necessary and reasonable in the circumstances (for instance, renting a car for a reasonable period while your vehicle was being repaired, if the accident was the other driver’s fault, is a justifiable expense).

In short, even when the “verbal threshold” and deductible shut down a pain and suffering claim, an injured person is not left with nothing if they had financial losses. Ensure that all your accident-related expenses are documented, as these can be reclaimed from the at-fault party or their insurer. This is one reason why even relatively minor injury claims are not pointless – you might not get general damages for pain, but you can still be made whole for your bills and lost income. Of course, your own accident benefits (from your auto insurer) might cover some of those costs first, but any shortfall can be claimed in the tort lawsuit against the at-fault driver.

Conclusion: Striking a Balance Between Compensation and Costs

Ontario’s regime for car accident compensation is a delicate balance between compensating victims and controlling insurance costs. The threshold is intended to bar recovery for pain and suffering unless an injury is legitimately serious and long-lasting[5]. The deductible then further limits payouts even for those serious injuries, especially at the lower end of the severity scale. For injured individuals, these rules can come as an unwelcome surprise – the idea that you could endure pain and disruption from an accident yet receive no monetary acknowledgment of that suffering seems counterintuitive. For insurers and policymakers, however, the goal is to avoid a flood of minor injury claims and keep liability exposure (and thus premiums) in check.

The bottom line is, if you’re an accident victim or advocating for one, you need to clear two hurdles to get pain and suffering compensation: first, prove the injury meets the legal threshold of “permanent and serious”[4]; second, obtain a high enough assessment of damages to beat or substantially overcome the statutory deductible. If you fail the first, you get nothing for pain and suffering. If you pass the first but with a modest injury, you may still get little or nothing after the deductible. Only claims for truly significant injuries tend to result in sizable pain and suffering awards in Ontario’s system.

From a practical standpoint, anyone pursuing a car accident injury claim in Ontario should gather solid medical evidence about the permanence and severity of their injuries (doctors’ reports, specialists, etc.), because that will be critical for the threshold analysis. It’s also wise to consult a personal injury lawyer who can evaluate whether your injuries are likely to meet the threshold and estimate a reasonable range of damages. They can explain how the law will apply to your case and whether your claim is likely to surmount the deductible.

While Ontario’s threshold and deductible rules may limit compensation for pain and suffering, remember that full recovery of economic losses is still on the table – so you should claim for any income loss, treatment costs, and other expenses incurred due to the accident. Those concrete losses are not subject to these limitations[25]. In the end, understanding these rules arms you with realistic expectations and helps you focus on the evidence needed to maximize your recovery under the law. For lawyers, explaining these concepts to clients early on can prevent unpleasant surprises and help strategize the best path forward, whether that’s proceeding with a claim, gathering more medical support, or perhaps exploring settlement with these limitations in mind.

Ontario’s auto accident compensation scheme may be complex and, at times, seemingly harsh, but it reflects a policy choice about which injuries merit general damages. By being informed about the threshold and deductible, both legal professionals and accident victims can better navigate the system and ensure that truly serious injuries are properly documented and advocated for – and that no available compensation for losses is left on the table.

Sources:

- Ontario Insurance Act, s. 267.5(5) – the statutory threshold for non-pecuniary damages[2]

- Chodola Reynolds Binder Law, Understanding Pain & Suffering and the Injury Threshold in Ontario – explanation of the threshold test and examples of serious impairment[10][6]

- Lexology (Boland Romaine LLP), What are General Damages in Personal Injury? – overview of threshold criteria and the statutory deductible (2023–2024 figures)[4][18]

- Wards Lawyers PC, The “Deductible” in Motor Vehicle Accident Cases – A Barrier for the Injured – discussion of the 2024 deductible, its application, exceptions, and the fact it only applies to pain and suffering (not income loss or other damages)[14][25]

- Bogoroch & Associates LLP, 2025 Increases to Statutory Deductibles and Monetary Thresholds – updated 2025 deductible and threshold amounts, and confirmation of the pain and suffering damages cap (SCC inflation-adjusted limit)[17][24]

- Lexology, Implications of Increasing Deductibles (Michael Connolly) – insight on how the threshold and deductible discourage minor injury claims and benefit insurers[5].

[1] [4] [5] [12] [13] [18] [19] [22] What are General Damages in Personal Injury? – Lexology

[2] [3] [6] [9] [10] [11] [26] Pain, Suffering, and the Injury Threshold in Ontario | Chodola Reynolds Binder

[7] [8] Threshold for Non-pecuniary Damages Met for Chronic Pain Injury

[14] [15] [16] [20] [21] [23] [25] THE “DEDUCTIBLE” IN MOTOR VEHICLE ACCIDENT CASES – A BARRIER FOR THE INJURED – Wards Lawyers PC

[17] [24] 2025 Increases to Statutory Deductibles and Monetary Thresholds – Bogoroch & Associates LLP